what is a fit deduction on paycheck

These withholdings constitute the difference between gross pay and net pay and may include. Employers withhold or deduct some of their employees pay in order to.

Different Types Of Payroll Deductions Gusto

FICA means Federal Insurance Contribution Act.

. TDI probably is some sort of state-level disability insurance payment. 1 medicare and 2 social. FICA would be Social Security and Medicare which are not deductions nor credits on your income tax return.

Federal income taxes or FIT is calculated on an employees earnings including regular pay bonuses commissions or other types of taxable earnings. Calculate Federal Income Tax FIT Withholding Amount. These items go on your income tax return as payments against your income tax liability.

On your paycheck it will show how much your federal income taxes are under the term federal withholding. Click to see full answer. FIT tax refers to Federal Income Tax.

They go toward costs needed to run the federal government. FIT Fed Income Tax SIT State Income Tax. On every paycheck employers have the obligation to withhold and remit to the government the federal income taxes owed by their employees.

For most people FIT are the taxes that employers are expected to withhold from your paycheck. FICA would be Social Security and Medicare which are not deductions nor credits on your income tax return. The rate is not the same for every taxpayer.

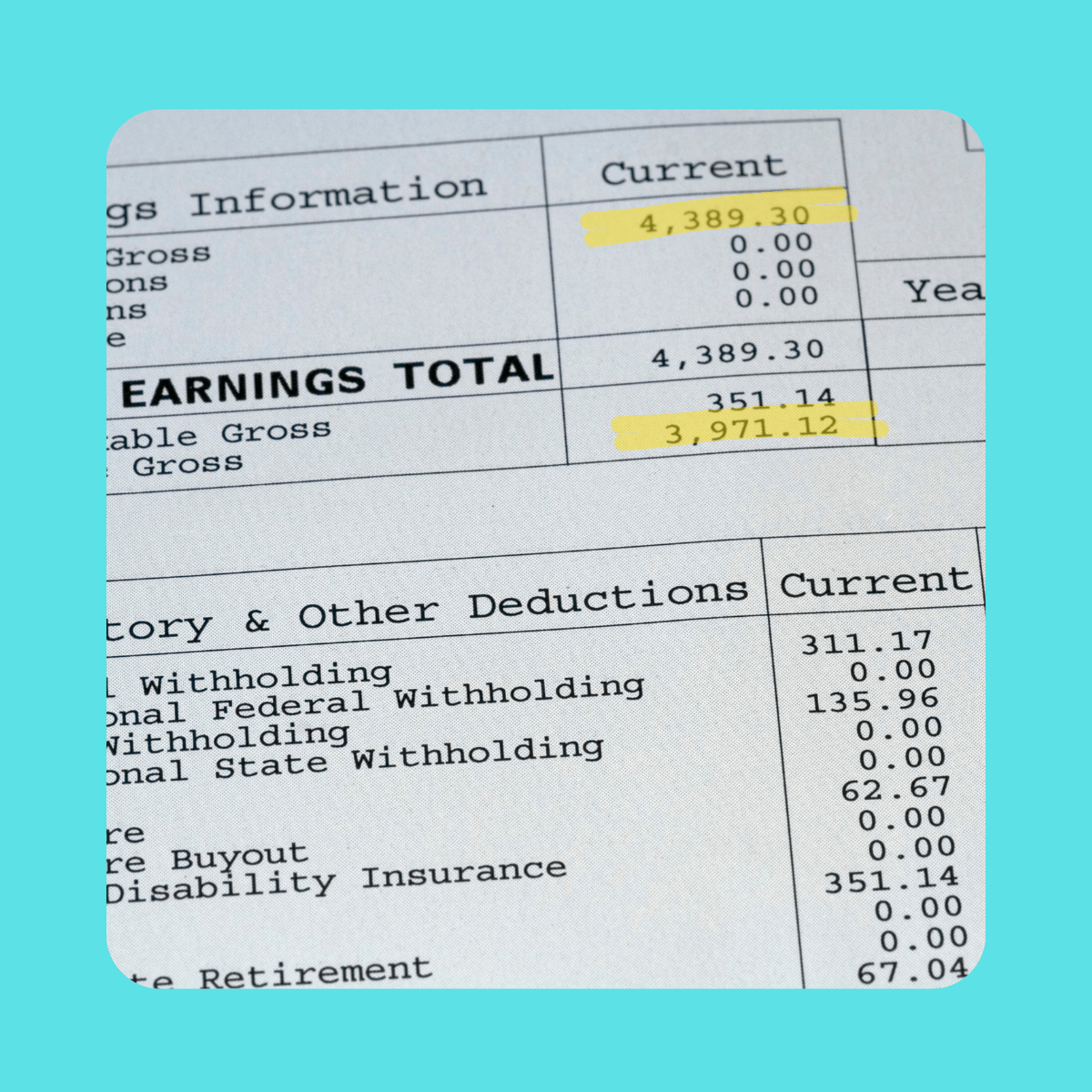

Federal income tax deduction refers to the amount of federal income taxes withheld from an employees paycheck each pay cycle. FIT means federal income taxes. FIT deductions are typically one of the largest deductions on an earnings statement.

The employees adjusted gross pay for the pay period. On a pay stub this tax is abbreviated SIT. To calculate federal income tax withholding you will need.

Answer 1 of 2. Some are income tax withholding. A copy of the tax tables from the IRS in Publication 15.

If you see the fit deduction listed on your paychecks earning statement it is an acronym for federal income tax. It covers two types of costs when you get to a retirement age. FIT stands for federal income tax.

Federal Tax Withheld 2019 carfareme 20192020 from wwwcarfareme. FIT is applied to taxpayers for all of their taxable income during the year. To calculate Federal Income Tax withholding you will need.

Knowing what is. Make sure you have the table for the correct year. To calculate your tax bill youll pay 10 on.

Payroll deductions are wages withheld from an employees total earnings for the purpose of paying taxes garnishments and benefits like health insurance. Thereof what is fit on my paystub. Income taxes are taxes on income both earned salaries wages tips commissions and unearned interest dividends.

The employees W-4 form and.

Payroll Deduction Form Template New 10 Payroll Deduction Forms To Download Payroll Deduction Payroll Template

Pay Stub Examples And Importance Is Our Article Which Is Meant To Provide Basic Details About Pay Stub Formats Payroll Template Good Essay Resume Template Free

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

What Everything On Your Pay Stub Means Money

Federal Income Tax Fit Payroll Tax Calculation Youtube

Understanding Your Paycheck Credit Com

Hrpaych Yeartodate Payroll Services Washington State University

Employee Payroll Form Template Google Docs Word Apple Pages Template Net Payroll Templates Employee

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

Understanding Your Paycheck Paycheck Understanding Yourself Understanding

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

Payroll Deduction Form Template Google Docs Word Apple Pages Template Net Payroll Deduction Templates

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

Understanding Your Pay Statement Office Of Human Resources

Mathematics For Work And Everyday Life

What Is A Pay Stub Loans Canada

/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)

Payroll Deduction Plan Definition

Organisation Pay Stub Template Google Docs Word Template Net Payroll Template Templates Free Organization

Employee Life Insurance Employee Benefit Benefit Program Business Insurance